This post was originally published by RFPIO.

RFP automation is causing a wonderful shift. Proposal management teams of yesteryear relied on antiquated processes when responding to RFPs. Valuable time was spent on repetitive tasks. Information and departmental silos kept teams from reaching their fullest revenue-generating potential as a collaborative unit.

I know what responding used to be like before RFP automation. I used to be a responder. As a product manager, I was a subject matter expert (SME) who regularly contributed to RFP responses. I spent 30% of my time responding to RFPs. There were many redundancies and inefficiencies, all of which impacted my ability to focus on my work.

Automated technologies have cropped up across every vertical, including proposal management. Before we only had manual processes. Now, with RFP automation, we have options and opportunities to advance the RFP response process.

RFP automation has transformed proposal management

Billions of years ago (in the late 2000s), marketing automation caused an important shift in email marketing. Automation allowed marketers to achieve more as a team and make a bigger impact on revenue.

Over the past few years, the proposal management industry experienced the same transformative effect with RFP automation.

Achieve more as a team

It’s a collective effort to respond to an RFP, with involvement from multiple departments—sales, marketing, legal, finance, product, compliance, IT—and the list goes on. Often (but not always) there is a dedicated proposal manager directing these projects to keep everyone moving toward the same target…a timely, quality RFP submission.

Let’s use the old product manager version of myself to create a “before and after RFP automation” scenario. In the olden days, an RFP would come in. My proposal manager assigned questions to me—the all too familiar questions I had answered many times before on other proposals.

I spent my time looking through folders and documents to copy and paste previous responses. By the time I did that, I had little time to ensure quality control. If my proposal manager had RFP automation, they would have used the answer library capabilities to populate the responses with relevant content. My involvement from there would consist of oversight, making sure the content was accurate and optimized.

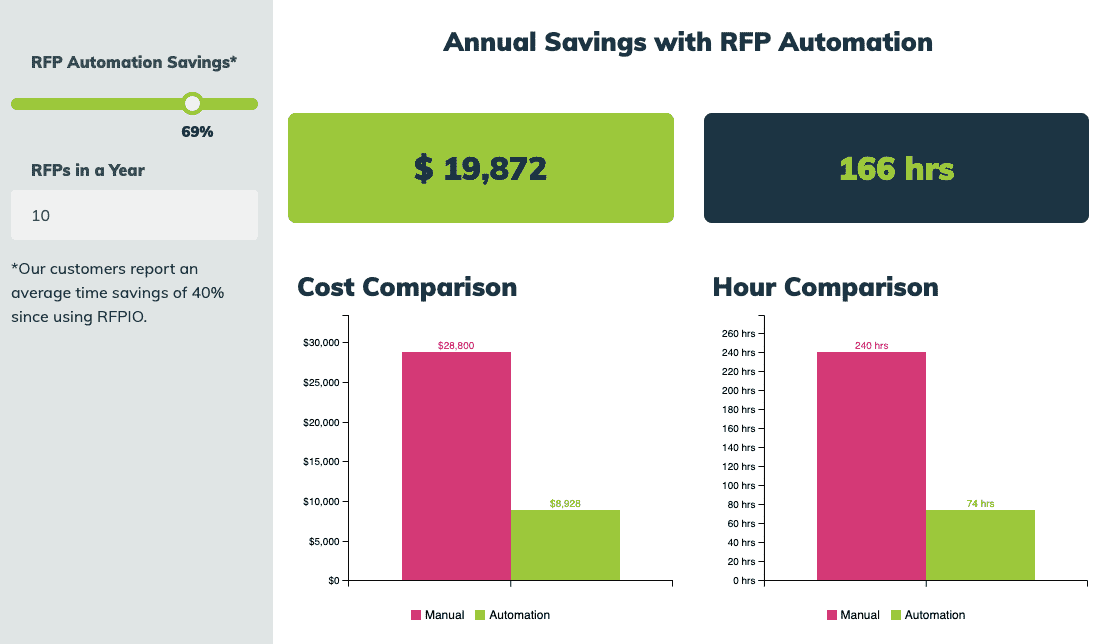

Automation helps teams maximize resources and time being spent on RFPs. Time-savings with responding to RFPs allow team members to return to other high-priority tasks. Some of the organization’s most valuable and costly resources are involved in RFP responses. If an organization responds to 100 RFPs in a year, this really adds up.

Your Turn…Use Our ROI Calculator to Calculate Your Annual Savings

Make a bigger impact on revenue

Achieving more with RFP automation also means responding to more RFPs. 49% respond to less than 50 RFPs annually. Imagine the revenue impact these responders can make with technology like RFP software. Could they respond to 75 RFPs? How about 100+?

Without automation, response management teams can only dream of increasing RFP submissions. They respond to RFPs in a reactive state, which, of course, is not the way to produce a quality deliverable for the prospect.

Saving time through efficient processes turns into extra hours to consider viable business opportunities—perhaps even breaking into new markets. RFP automation gives your team the space to establish a proactive process, where technology handles much of the heavy lifting. Team members are brought in to use their strengths to strengthen the content—and the chances of winning the deal.

A consolidated solution for RFP management

When we set out to build a consolidated (and better) solution for RFP management back in 2015, over and over we heard that responders wanted a platform that would help them improve collaboration and automate workflows.

A few RFP management solutions existed, but they were not easy to use. And these solutions didn’t integrate with systems teams were already using across their organization—CRMs like Salesforce, communication tools like Slack, or cloud storage like Google Drive.

Organizations of all sizes are managing so much technology—all the more reason to select a robust platform that meets specific business needs and scales with the business. RFPIO is a consolidated RFP management solution that advances the response process through…

Artificial intelligence

Artificial intelligence (AI) is changing the way we all work, including how proposal management teams “shred” their RFPs. It’s easier to break up relevant sections, auto-identify response content, and assign questions to subject matter experts.

Integrations

Our integrations keep all team members working in their preferred tools. Salespeople don’t want to leave their CRM to respond to RFPs and they no longer have to. SMEs are unreachable by email, but they’ll engage through Slack.

Content management

The answer library is the content management hub—not only for RFPs, but for all company information. Anyone has access to the latest and greatest content, which can be easily searched, selected, and inserted into a variety of business documents…even emails.

All responders have stories to share. Do you want to tell your organization’s story with a disappointing ending…or a happy ending? When you find a consolidated solution for RFP management, you’ll automate, improve—and ultimately—advance your RFP response process.