This post was originally published by Omar Qari at Emburse.

One of the biggest questions on the minds of millions of people around the world, and the business travel industry in particular, is when organizations will begin allowing their employees to take both domestic and international trips.

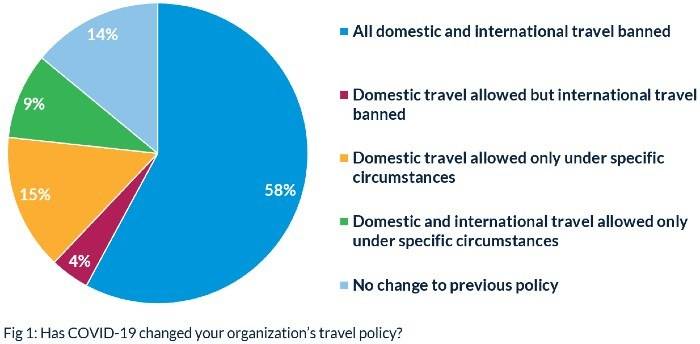

We surveyed more than 500 business travel and finance professionals from organizations across the globe about how the pandemic has impacted their organizations and their teams’ travel plans, and also when they anticipate getting started again. In total, 86% of responding organizations had either restricted or completely banned travel, with 58% banning any form of travel.

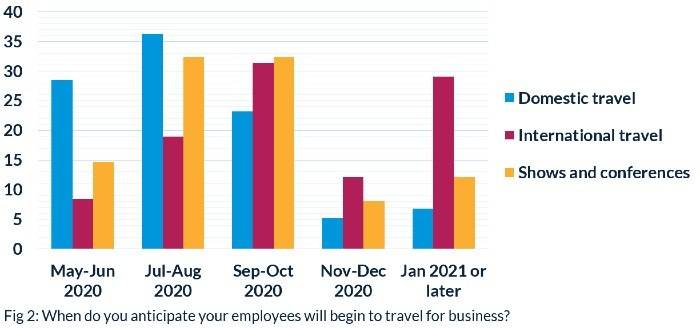

Of the organizations that had placed restrictions on employee travel, 29% of them anticipated returning to domestic travel before the end of June 2020, with almost two-thirds (65%) before then end of August 2020, 88% before the end of October, and fewer than 7% predicting that domestic business travel will be on hold until 2021.

However, respondents were more cautious about attending large events. Just 47% of survey respondents anticipate their employees returning to in-person events before the end of August. This number rises to 79% by the end of October, although this figure may be skewed slightly as many conferences that were planned earlier than the summer were either cancelled, turned into virtual events, or rescheduled to later in the year.

International travel is expected to start even more slowly, according to the survey. Just 9% of organizations anticipate international travel starting again before the end of June, with barely a quarter (27%) expecting employees to take overseas trips before the end of August. While this number grows significantly to 58% by the end of October, 29% of companies will not be planning overseas travel before 2021.

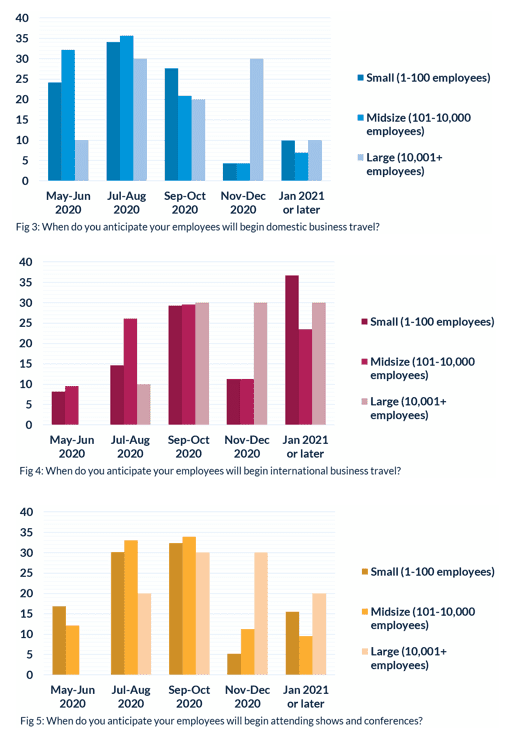

Small and midsize organizations are clearly more optimistic than larger organizations for when they expect travel restrictions to be eased. The majority of smaller and midsize organizations anticipate the domestic travel will have restarted before the end of August, compared to just 40% for large enterprises. The gulf is even more pronounced for international travel. Just 10% of respondents from large enterprises anticipate overseas travel starting before the end of August, compared to close to 20% for small organizations and almost 35% for midsize organizations.

Of course these figures could be impacted by both local and national governments’ decisions on easing restrictions, as well as any potential second wave of infections. However, all being well, by the time businesses enter the critical final quarter of the year, most organizations will be allowing their teams back on the road. Analyst firm Gartner also found that T&E is one of the first areas of spend that will be restarted once revenues return.

One thing we can expect, though, is that whenever business travel does start back up again, it will look a lot different than before, with flights at lower capacity, handshakes replaced by smiles, and travelers being far more cautious of their surroundings. It is also likely there will be revised expense management programs in place to both manage expenses and ensure compliance to new policies.

Sources:

Online survey of 504 corporate travel and finance professionals, conducted April 2020

https://www.emburse.com/when-will-business-travel-take-off-again

About the Author

Omar Qari, Head of Corporate Strategy & Business Development at Emburse.

As head of corporate strategy and business development at Emburse, Omar is responsible for global strategic partnerships and M&A across all brands.

Omar has more than 10 years’ experience in B2B software. He joined Emburse in 2018 via the acquisition of Abacus, where he served as co-founder & CEO. Before his current role, he spent a year as GM of the Abacus business. Prior to Abacus, Omar spent five years in private equity, investing in financial technologies companies.

Omar pursued his MBA at The Wharton School and studied Computer Science at Wake Forest University.

More Resources:

Emburse: Virtualizing Financial Operations to Adapt to Increased Work from Home Requirements

McChrystal: Leading an Organization Through the Uncertainty of COVID-19: Part 5 – Leader’s Mindset

IRONSCALES: The Scattered Perimeter: A New Norm

Clarizen: The 10 Unexpected Joys of Virtual Happy Hour