K1 INVESTMENT MANAGEMENT

2023 Mid-Year Update

K1 remained active in the first half of 2023. On the buyside, we deployed capital across 11 new investments including Elmo (ASX:ELO), a take-private investment representing a new platform for K1 in human capital management software. On the sellside, K1 sold Zapproved to Exterro, a leader in the GRC software space. Meanwhile, in the financing market, our Debt Capital Markets team closed 12 debt financings raising over $800 million and fixed over 70% of our floating rate debt at an average SOFR rate of 3.94%.

K1 continued to invest in the “human element” of our portfolio companies as well. Our Recruiting team helped place 52 C-suite and board member hires and 93 other executive hires across the portfolio. We celebrated the 10th anniversary of our Advanced Management Program, a testament to our Operations Team’s commitment to continuous learning and development. Our Events Team orchestrated 18 Accelerate events, three functionally focused Summits, two investor relations events, and K1’s H1 Offsite gathering.

In addition, K1 received awards from GrowthCap, PrivateEquity CXO, the Los Angeles Business Journal, and Private Equity Wire ESG. Beyond our business endeavors, K1 remains dedicated to giving back to the community, emphasizing the importance of corporate social responsibility and making a positive impact. We also welcomed our largest Intern Class yet, fostering emerging talent in the industry.

Read on for our full 2023 Mid-Year Update.

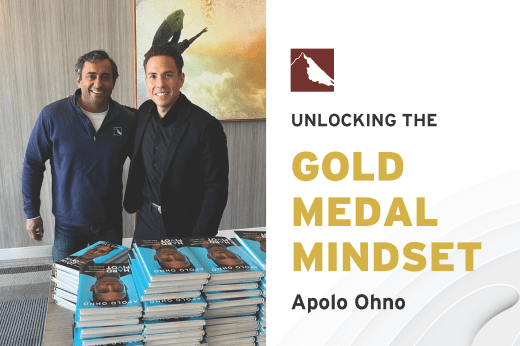

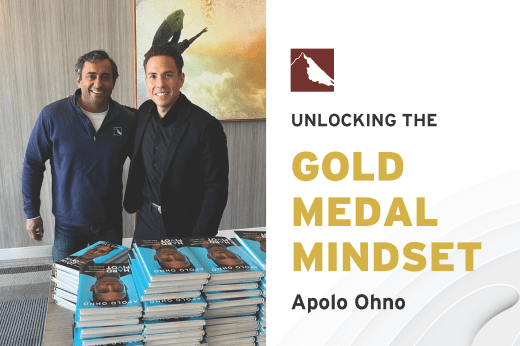

Last year, we launched K1 Accelerate to help develop our portfolio companies’ pipelines via K1’s network of enterprise executives. We started 2023 off strong, hosting 18 Accelerate events including four K1 Experiences: once-in-a-lifetime curated events to drive engagement with C-level execs from top-tier brands.

We’re excited to celebrate the 28 portfolio companies that made the 2023 Inc. 5000! This list recognizes the fastest-growing businesses in America based on a data-driven analysis of some of the most successful private companies in the market.

Ten years ago, our first AMP class began with just four members. Now, we’re thrilled to welcome 93 members to our newest class – our largest yet!

The K1 Advanced Management Program is a year-long mini-MBA curriculum that takes strong performers within our portfolio and provides them with the tools to better understand themselves, manage their teams, and ultimately lead whole functions and organizations. AMP graduates have gone on to become board members, C-suite executives and other leaders within the portfolio and beyond. We look forward to seeing how this year’s class grows over the course of the program.

We welcomed our largest Intern Class of 2023! Here are some notable stats about this year’s cohort:

This update (the “Update”) does not constitute an offer to sell or the solicitation of an offer to purchase any security, and is not presented with a view to providing investment advice with respect to any security or making any claim as to the past, current or future performance thereof. K1 Investment Management, LLC (together with its affiliates, “K1”) expressly disclaims the use of this Update for such purposes. This Update is solely intended to provide general information regarding K1’s operational activities, financing capabilities and general business experience. Portfolio companies presented herein are for informational purposes only and are intended to illustrate such historical activities. The portfolio companies included herein should not be assumed to have been profitable. Past performance is not necessarily indicative of future results. There can be no assurance historical trends will continue. K1 does not warrant the accuracy, completeness or usefulness of any information herein. Any reliance you place on such information is strictly at your own risk. K1 disclaims all liability and responsibility arising from any reliance placed on this Update or anyone who may be informed of its contents. Please note that the cited percentages in the Introduction reflect data for K1 control deals only. Total transaction count is as of August 15, 2023. Exit count includes the sale of Zapproved that was signed in December 2022 and subsequently completed in January 2023.

* K1 Operations is K1’s dedicated operational consulting affiliate. The K1 Operations team includes recruiters and is not employed by K1 (although K1 Operations is an affiliate of K1). Any fees, compensation, expense reimbursements or other amounts received by K1 Operations and its team are generally paid by a portfolio company or, subject to the terms and conditions of the K1 Funds’ limited partnership agreements, by K1 clients, and do not offset or otherwise reduce management fees. Accordingly, the fees and expenses of K1 Operations and its team are not covered by management fees.

Third Party Awards and Designations. The awards and designations presented on this website are the opinion of the respective parties conferring the award or designation and not of K1. No such person conferring any of the listed award(s) or designation(s) is affiliated with K1 or is an investor in K1-sponsored vehicles. The award does not reflect the experience of any client and is not based on, or indicative of, investment returns. The description and the selection methodologies of rankings and awards can be subjective and will often vary. There can be no assurance that other providers or surveys would reach the same conclusions as the foregoing.

2023 Private Equity Wire ESG AAA US Awards – AA Winner for ‘Best Corporate Sustainability Strategy: Management Company’ and ‘Best ESG Firm: Mid Cap’ – The ranking and award was conducted by Private Equity Wire in partnership with EthicsGrade to reward environmental, social and governance excellence among private equity fund managers across a wide range of categories. The time period upon which the award was based was January 2022 through December, 2022. The award was given on June 21, 2023. K1 paid a copyright and publication fee in connection with the award. In general, the receipt of compensation influences, and is likely to present a potential material conflict of interest, relating to any granted award.

This presentation identifies a number of benefits inherent in K1’s services and operations, although K1 is also subject to a number of material risks associated with these benefits. K1 believes that K1, its personnel and K1 Operations used, employed or retained by K1 will have competitive advantages in identifying, diligencing, monitoring, consulting, and improving and ultimately selling portfolio companies; however, there can be no guarantee that K1 will be able to maintain such advantages over time, outperform third parties or the financial markets generally, or avoid losses.

| Cookie | Duration | Description |

|---|---|---|

| ARRAffinity | session | ARRAffinity cookie is set by Azure app service, and allows the service to choose the right instance established by a user to deliver subsequent requests made by that user. |

| ARRAffinitySameSite | session | This cookie is set by Windows Azure cloud, and is used for load balancing to make sure the visitor page requests are routed to the same server in any browsing session. |

| Cookie Law Info - Analytics | 11 months | The cookie is used to store the user consent for the cookies in the category "Analytics". |

| Cookie Law Info - Check Advertisement | session | This cookie is used to record the user consent for the cookies in the "Advertisement" category . |

| Cookie Law Info - Necessary | 11 months | The cookie is used to store the user consent for the cookies in the category "Necessary". |

| Cookie Law Info Consent | session | Records the default button state of the corresponding category & the status of CCPA. It works only in coordination with the primary cookie. |

| Viewed Cookie Policy | 11 months | The cookie is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

| Cookie | Duration | Description |

|---|---|---|

| Google Analytics Tracking | 1 year | This cookie is set by Google Analytics. |